There has been a persistent claim circulating in public discourse that millions of deceased individuals are actively receiving Social Security benefits. This idea has been amplified by prominent figures, including Elon Musk, who has suggested that the Social Security Administration (SSA) is riddled with inefficiencies and fraud. But is there any truth to these claims? Let’s break this down and separate fact from fiction.

The Claim: Millions of Dead People Receive Social Security Benefits

The claim that millions of deceased individuals receive Social Security payments is not new. Various public figures have repeated it over the years, often to criticize government inefficiency or justify reforms to entitlement programs. Elon Musk recently echoed this sentiment, suggesting that the SSA is paying benefits to millions—or even tens of millions—of dead people. However, evidence does not support this assertion and misrepresents how the Social Security system operates.

How Social Security Works After Death

When a person receiving Social Security benefits passes away, the SSA has mechanisms in place to ensure that payments are stopped. One key tool used to report deaths is Form SSA-721, also known as the "Statement of Death by Funeral Director." Funeral homes typically fill out this form and submit it to the SSA as part of the death reporting process. This system helps ensure that benefits are terminated promptly for deceased individuals.

In addition to funeral home reports, the SSA receives death notifications from other sources, such as state vital statistics offices, family members, and financial institutions. Once a death is reported and verified, any future payments are halted. If payments were issued after someone’s death due to a delay in reporting, the SSA typically recovers those funds.

The Reality: Fraud and Errors Are Rare

While it’s true that no system is perfect, instances of improper payments to deceased individuals are exceedingly rare in the context of Social Security’s massive scale. The SSA administers benefits to over 67 million people each month, disbursing approximately $1 trillion annually. Inevitably, occasional errors—such as payments issued after a beneficiary’s death—represent a tiny fraction of total disbursements.

Key Statistics on Improper Payments:

From 2015 to 2022, the SSA made $71.8 billion in improper payments out of $8.6 trillion disbursed—less than 1% of total payments.

Only a small portion of these improper payments involved deceased individuals. Most errors were due to living beneficiaries' overpayments (e.g., income misreporting or eligibility changes).

The SSA has also implemented safeguards to prevent fraud involving deceased individuals. For example, since 2015, the agency has required proof of life for anyone aged 115 or older still listed as receiving benefits—a practical measure given that very few people live beyond this age.

Misinterpretation of SSA Data

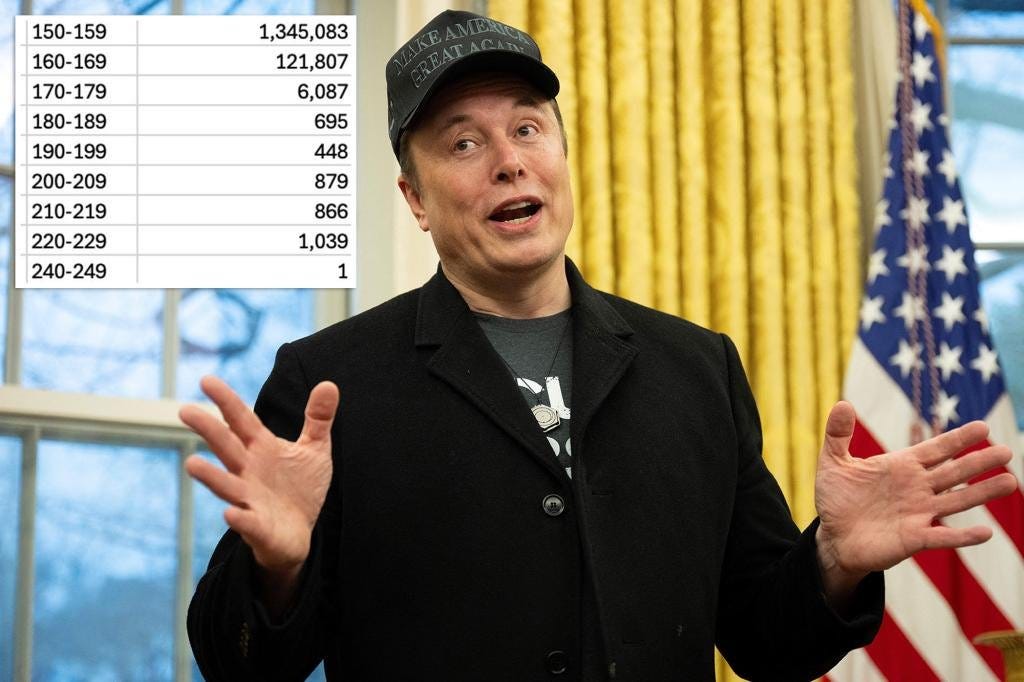

Much of this issue's confusion stems from misunderstanding how the SSA’s databases work. Critics often cite data from the SSA’s Numident database, which contains records for every individual who has ever been issued a Social Security number (SSN). This database includes many deceased individuals whose deaths were never formally recorded in the system—particularly those who lived before electronic record-keeping became widespread.

For example:

A 2023 report found nearly 19 million people born before 1920 listed in the Numident database without recorded death dates.

However, being listed in this database does not mean these individuals are receiving benefits. In fact, most of them never received benefits during their lifetime because they died before becoming eligible or before modern tracking systems were implemented.

Critics like Musk have conflated these outdated records with active benefit recipients, leading to exaggerated claims about fraud and inefficiency.

Why Claims About "Millions" Are Implausible

Let’s put this into perspective: The total number of people receiving Social Security benefits is around 67 million as of 2025. If "millions" or "tens of millions" of deceased individuals were indeed receiving payments—as Musk suggested—it would imply that a significant portion of all beneficiaries are dead. This is mathematically implausible and unsupported by any credible evidence.

Additionally:

To ensure accuracy, the SSA actively cross-checks its records with federal and state death registries.

Any overpayments made due to delayed death reporting are typically recouped by withholding funds from survivors’ benefits or other means.

The Role of Form SSA-721: A Critical Safeguard

Form SSA-721 plays an important role in preventing improper payments after death. Funeral directors use this form to notify the SSA when someone dies, ensuring their benefits stop promptly. This process also helps surviving family members apply for any benefits they may be entitled to, such as survivor’s benefits or one-time death payments.

While no system is perfect, this reporting mechanism significantly reduces the likelihood of errors or fraud involving deceased beneficiaries.

What About Fraud?

Fraud involving Social Security benefits does exist but is extremely rare compared to the scale of the program. Most cases involve identity theft or false claims rather than systemic issues with paying benefits to dead people.

The SSA has robust anti-fraud measures in place, including:

Regular audits.

Cross-referencing data with external sources (e.g., IRS records).

Investigations conducted by the Office of Inspector General (OIG).

These efforts have helped keep fraud rates low and ensure that taxpayer dollars are used appropriately.

Conclusion: Elon Musk's Claims Don't Hold Up

The idea that millions—or even tens of millions—of deceased individuals are receiving Social Security benefits is not true. While isolated instances of improper payments occur, they are rare and represent less than 1% of total disbursements. The SSA has effective systems in place to stop payments after death and recover funds when errors occur.

Elon Musk’s claims appear to be based on a misunderstanding—or misrepresentation—of how Social Security databases work and how improper payments are tracked. By perpetuating these myths, critics risk undermining public trust in a program that critically supports millions of Americans.

In reality, Social Security remains one of the most efficiently run government programs in terms of minimizing fraud and errors. While there’s always room for improvement, the notion that it is riddled with fraud involving dead beneficiaries is unfounded and misleading.

Sources:

Musk misreads Social Security data, millions of dead people not getting benefits, experts say

Musk's claims of Social Security payouts to dead people lack evidence

New Social Security chief refutes claims of deceased people over 100 years old getting checks

Social Security sending out checks to millions of dead people? It’s not just false. It’s absurd